There are few things worse than going through a breakup. While there’s the initial shock, confusion and loneliness to deal with at first, knowing how to deal with your assets can sometimes be the hardest part of the whole process.

No matter if you were in a marriage or a de facto relationship, you will still need to work out how your assets will be divided – these assets can include everything from property, cash or superannuation, even if they are just in your name or your former partner’s name.

While you and your former spouse or de facto partner can agree on how your property should be shared without any arguments in court, it is always best to seek legal advice to determine the best way to go about what can be a very draining process.

At Ilberys, we understand just how confusing and exhausting sorting out a property settlement after a relationship breakdown can be. That’s why we’ve put together some key information about the property settlement process and what options you and your former partner have.

What is a property settlement?

A property settlement is an arrangement made between you and your former partner that officially outlines how your assets, liabilities and financial resources will be divided.

Most people who have property in Australia or who are resident in Australia are able to have a property settlement if their de facto relationship or marriage breaks down. This can be requested by either party to the relationship.

But how do you decide this?

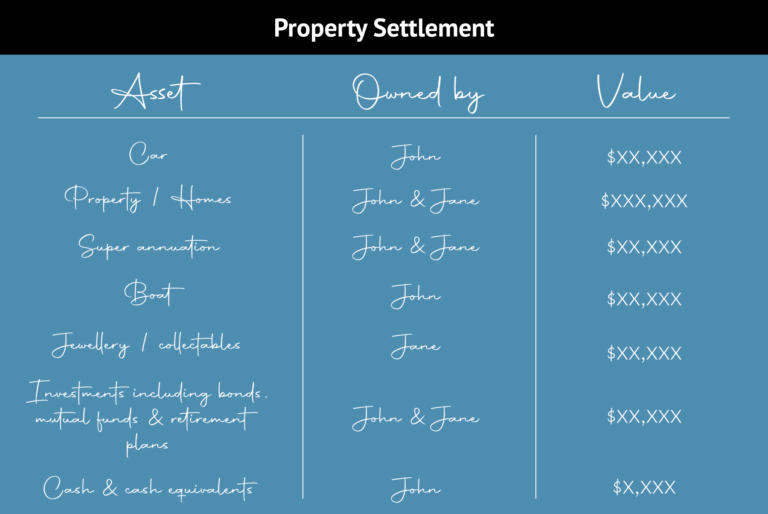

Deciding how anything is to be shared is never easy, especially when property is involved. The best practice here is to put together a precise list that details all assets, debts, financial resources and their estimated values.

Next to each asset, debt or financial resource, you can jot down a rough value and whether the asset is currently owned in your name, your former partner’s name, if it is shared between you or if it is held in a business, company or trust.

By writing down this list, when you approach a lawyer for legal advice you will be prepared for the next steps. If you have any documents handy that you can use to verify the existence and value of the assets, this will make the process easier.

As deciding how bigger assets such as cars and properties are to be split between two parties can be tricky, Ilberys recommend seeking legal advice to help you understand your entitlements. While the input of a lawyer is not necessary, legal advice will help ensure that you are making a fully informed decision. Sometimes, it’s not just property in you or your former partner’s name is that relevant: property held by friend or family member should, in certain circumstances also be included in a property settlement. This is another area where legal advice will help you understand how you should approach the situation.

How do you formalise a property settlement?

Don’t come to any agreement with your former partner without recording it legally. This can be done in two ways:

- through Consent Orders; or

- with a Binding Financial Agreement

Even if your agreement is in writing and signed by you and your former partner, if it is not formalised through consent orders or in a binding financial agreement, you or your former partner can still ask the Family Courts to make orders which go against the agreement.

Consent Orders

Once you and your former partner have come to an agreement about how your assets are shared, this can be finalised through the Family Courts with Consent Orders. You and your former partner sign and lodge an Application for Consent Orders, which will be examined by a Court Registrar to confirm that your agreement is just and equitable. If so, the Court will turn your agreement into Consent Orders, which will then be legally binding. There are very few, very difficult ways by which a party can later seek to have the Consent Orders changed (such as if one party was fraudulent, or did not properly disclose their property).

Obtaining Consent Orders is typically a relatively easy process provided all of the necessary and correct information is provided in the application and you and your former partner are in agreement. Despite involving the Court, a formal court hearing is not necessary here.

A Binding Financial Agreement

On the other hand, a Binding Financial Agreement is not reviewed by a Court Registrar. A Binding Financial Agreement is an agreement between parties which has not been scrutinised by a Court to ensure it is just and equitable. If you and your former partner agree about how your assets should be divided, you can compose a private contract that will still formalise this division without the approval of the court.

This written agreement must be prepared in strict accordance with the legislative requirements of the Family Law Act 1975 (Cth) or the Family Court Act 1997 (WA) , depending on whether the parties were married or in a de facto relationship. There are several legislative requirements, and one of the most significant is that each party must receive independent legal advice, each from a different lawyer, about the effect of the agreement, and the advantages and disadvantages of entering into it.

Because of these requirements, Binding Financial Agreements are typically more expensive than consent orders and can give rise to far more uncertainty. It is also important to note that, once you enter into a Binding Financial Agreement, the Family Court cannot make an order which is contrary to the agreement.

Ilberys recommend reaching out for legal advice around which agreement is the best fit for you and your former partner.

What happens when your partner won’t respond to a property settlement?

Relationship breakdowns are always tricky, especially if you and your partner don’t see eye-to-eye on how your assets should be shared fairly.

If you are struggling to get your former partner to respond to a property settlement, you are able to apply for court action where the Family Courts will determine how your property can be shared in a just and equitable way. The Courts can also order a person to disclose their property and to attend mediation to try and reach an agreement. However, as court action is so pricey, it’s best to see this as purely a last resort.

How is property settlement determined by a court?

In an ideal world, two former partners would be able to determine property settlement on their own. However, sadly sometimes court intervention is necessary as it can be too difficult to come to a decision that satisfies both parties.

Property settlement is determined in the Family Courts by using a five step process:

- Considering whether the Court should intervene at all (the “Threshold” test). Where there is an established relationship with substantial shared property or finances, the Court will ordinarily consider it appropriate to intervene.

- Identifying and valuing all assets and liabilities owned by each party to the relationship, whether legally in one of their names or whether held by someone else temporarily.

- Considering the contributions each party has made to the property of the relationship and to the care and welfare of the family – what did each person do by way of childcare and duties around the home? What did each party contribute financially? What did each party contribute non-financially? Were these direct or indirect contributions?

- Taking into consideration the future needs, earning capacity and financial positions of the parties based on the information they have about the former couple.

- Reflecting upon the previous steps to consider if the decisions made will be just and equitable, no matter the circumstances.

Why is formalising property settlement so important?

No matter if you choose to opt for a Binding Financial Agreement or Consent Orders, a formalised property settlement has the very useful benefit of being legally binding. In other words, if your former partner violates the agreement the Court can step in to legally impose adherence to the agreement.

A property settlement also offers what is probably some much needed finality towards you and your former partner’s financial relationship – with such an agreement, no further property settlement claims will be able to be made, and you and your former partner can start to move on and regain independence.

How can Ilberys help?

As a preferred family law practice in Perth since 1955, we pride ourselves on our ability to provide objective and reasonable advice in property settlement situations.

As we understand nobody wants a property settlement to drag on and everybody wants certainty and finality, , so you can rest assured that once it is sorted, it will be sorted once and for all. As the no-shortcut lawyers, we believe in managing property settlement courses with finality and practicality: there is no point spending years arguing minor matters of property settlement, when that time could be better spent getting on with life.

Are you struggling to understand what’s required of you and your former partner? Reach out to Ilberys for a free and confidential initial consultation here – your partner won’t even know you’re seeking our advice.